How To Improve Return On Assets | Return on assets is a key metric shareholders' use to assess a company's use of capital, and is perhaps the most effective metric to measure how well operations are performing. What is return on assets (roa)? How does return on equity relate to return on sales and return on assets? One can improve roe or return on equity by simply increasing one's net income for the given amount of equity. Return on assets, roa, is an indicator of how a business manages existing assets when generating earnings.

Roa = net income/total assets. If roa is low the management may be inefficient while a high roa figure shows the improving overall profit. They need to take active measures to improve their performance. Rnoa evaluates how much operating income a company derives relative to the operating assets it holds. How many dollars of earnings they derive from each dollar of assets they control.

How can a company increase its return on total assets? Contributor jacob baadsgaard shows how roas, or return on ad spend do you want to improve your paid search campaigns? Discover how to calculate your company's asset turnover ratio and use the results to help improve your productivity. Without the ability to control roa on a granular level while performing continuous process improvement, down to the. One can improve roe or return on equity by simply increasing one's net income for the given amount of equity. It determines how much income or profit is generated for each dollar invested in entity's assets. To see how profitable your assets are, learn how to find return on assets and its impact on your business. For every dollar, they created, how many assets were they able to create the shareholders. It tells you what percentage of every dollar invested in the this ratio is more useful in some industries than in others, partly because how much money your business has tied up in assets will depend on your. If a business posts a net incomenet. The lemonade stands have asset turnover ratios of 0.5 and 1.0, respectively. The return on assets (roa) shows the percentage of how profitable a company's assets are in generating revenue. Enterprise digital asset management platforms.

How does return on equity relate to return on sales and return on assets? Return on equity tells you how efficiently a company is using its assets to generate earnings. There are a lot of paid search metrics, but one of the most useful and most underused is return on ad spend (roas). Whether you're buying equipment or stocking up on inventory, every dollar you put into your business should deliver a return by generating revenue or helping you improve your profits. The lemonade stands have asset turnover ratios of 0.5 and 1.0, respectively.

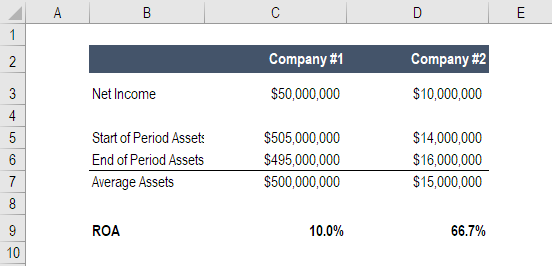

In the broadest sense, says knight, it's the ultimate roi. Roa = net income/total assets. Not surprisingly, the second company also has a higher return on equity. To explain how profit margins affect return on equity, i've constructed financial statements for a lemonade stand before and after a price increase. Dupont analysis views return on equity as the product of three factors: Increasing any one of these factors while holding the others constant would increase the. Return on assets is a key metric shareholders' use to assess a company's use of capital, and is perhaps the most effective metric to measure how well operations are performing. The return on assets compares the net earnings of a business to its total assets. The return on assets ratio, often called the return on total assets, is a profitability ratio that measures the net income produced by total assets during a since company assets' sole purpose is to generate revenues and produce profits, this ratio helps both management and investors see how well the. Roa shows how effectively the company can make use of its assets to get maximum profit. Discover how to calculate your company's asset turnover ratio and use the results to help improve your productivity. Return on assets (sometimes known as return on total assets) is a financial ratio that tells how much profit a company can generate from its assets. Return on assets, or roa, is a metric expressed as a percentage for measuring the performance of a company or other investment.

One can improve roe or return on equity by simply increasing one's net income for the given amount of equity. To calculate roi, use the general formula provided below: Your return on assets, or roa, indicates how profitable your business is by comparing net income with your total assets. Return on assets shows how much the company made for the assets it possesses. Discover how to calculate your company's asset turnover ratio and use the results to help improve your productivity.

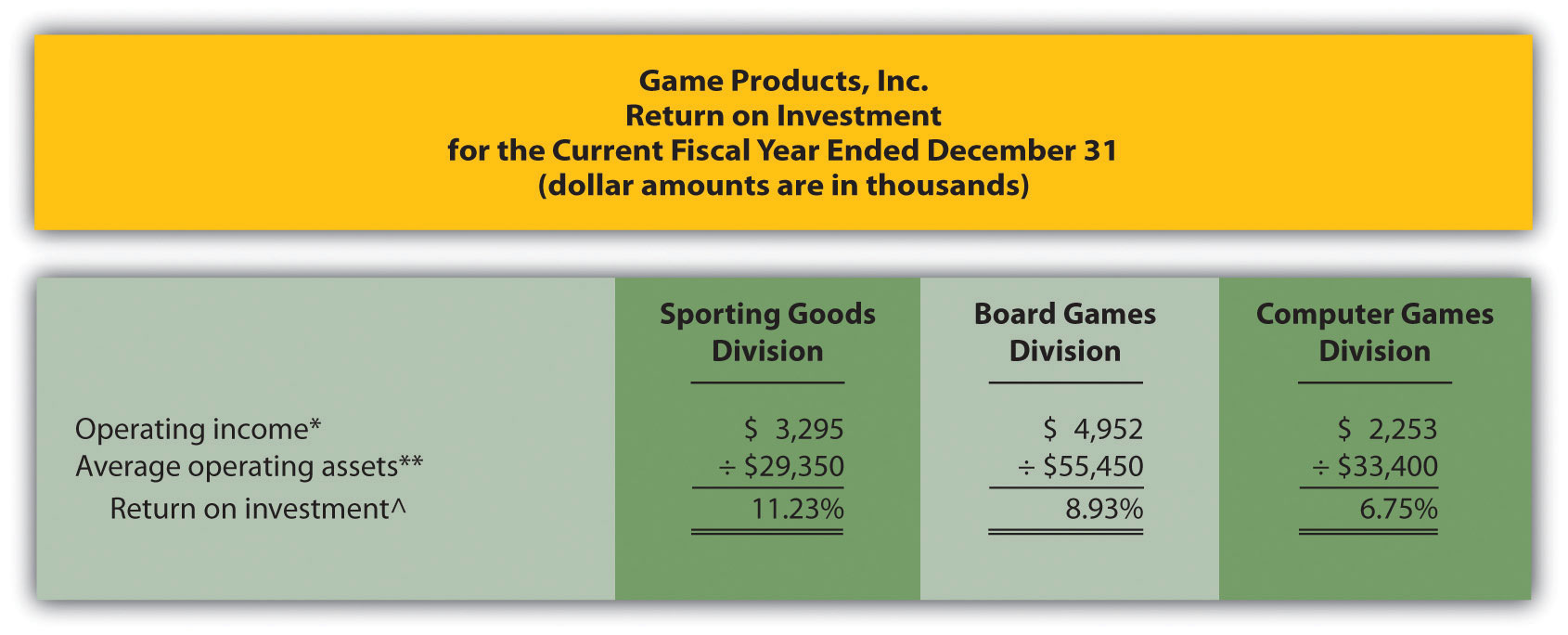

Other teams can't come close, even when they have billions of dollars of assets at their disposal. It provides an estimate of the efficiency of management in using assets they could hold off on certain discretionary expenses in order to improve profits. Return on assets, also called return on investment, is calculated by dividing a company's net income by its total assets. A higher operating roa is preferred and while analyzing this ratio, the analyst must analyse the historical performance and also compare it with the peers in the industry. Return on equity told how us how management was able to generate profits from the shareholder's equity. Roa makes you understand how efficiently did the company use its assets to earn the return for the year. The roa figure can motivate management to make better use of assets. The return on assets compares the net earnings of a business to its total assets. This video takes you through the return on assets formula, shows you how to calculate roa, how to interpret roa, and gives suggestions on how to improve roa. Return on assets links together information from two of the three main financial statements. This is called return on assets, or roa. Whereas return on assets considers all types of profits — including investing and financing profit — and assets like investments and securities, rnoa is comprised of only operating activities. Profit margin, financial leverage and asset turnover.

How To Improve Return On Assets: This number tells you what the company can do with what it has, i.e.

Source: How To Improve Return On Assets